| 談天說地主旨 ﹝請按主旨作出回應﹞ 下頁 尾頁 | 寄件者 | 傳送日期

|

| [#9714] 港股前瞻 今日大陸爆咩? |

tonywong 203.xxx.xxx.31 |

2020-07-20 11:45 | |

|

|

|||

| [#9713] 港股前瞻 #9711 thanks Richard 兄。 |

spyder 14.xxx.xxx.124 |

2020-03-24 14:52 |

| [#9712] 港股前瞻 700幾時1000?  |

pharm 218.xxx.xxx.3 |

2020-03-24 12:25 |

| [#9711] 港股前瞻 假如停牌幾個月之後,畀人清埋盤,咁又點計呢? _______________________________________________ 清埋盤前個價,用現金埋單找數!通常你都發左啦! |

RichardLui 182.xxx.xxx.183 |

2020-03-23 21:19 |

| [#9710] 港股前瞻 #9700 到時真係第三次世界大戰. |

Syuencb 113.xxx.xxx.21 |

2020-03-23 19:57 |

| [#9709] 港股前瞻 想請教下各位大大:如果沽空咗一隻股票,而佢之後停咗牌,咁點計? 假如停牌幾個月之後,畀人清埋盤,咁又點計呢? |

spyder 221.xxx.xxx.156 |

2020-03-23 18:32 |

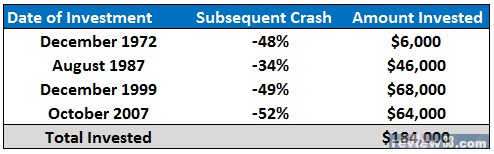

| [#9708] 港股前瞻 What if You Only Invested at Market Peaks? Posted February 25, 2014 by Ben Carlson Meet Bob. Bob is the world’s worst market timer. What follows is Bob’s tale of terrible timing of his stock purchases. Bob began his career in 1970 at age 22. He was a diligent saver and planner. His plan was to save $2,000 a year during the 1970s and bump that amount up by $2,000 each decade until he could retire at age 65 by the end of 2013 (so $4,000/year in the 80s, $6,000/year in the 90s then $8,000/year until he retired). He started out by saving the $2,000 a year in his bank account until he had $6,000 to invest by the end of 1972. Bob’s problem as an investor was that he only had the courage to put his money to work in the market after a huge run-up. So all of his money went into an S&P 500 index fund at the end of 1972 (I know there were no index funds in 1972, but just go with me here…see my assumptions at the bottom of the post). The market dropped nearly 50% in 1973-74 so Bob basically put his money in at the peak of the market right before a crash. Yet he did have one saving grace. Once he was in the market, he never sold his fund shares. He held on for dear life because he was too nervous about being wrong on both his sell decisions too. Remember this decision because it’s a big one. Bob didn’t feel comfortable about investing again until August of 1987 after another huge bull market. After 15 years of saving he had $46,000 to put to work. Again he put it in an S&P 500 index fund and again he invested at a market peak just before a crash. This time the market lost more than 30% in short order right after Bob bought his index shares. Timing wasn’t on Bob’s side so he continued to keep his money invested as he did before. After the 1987 crash, Bob didn’t feel right about putting his future savings back into stocks until the tech bubble really ramped up at the end of 1999. He had another $68,000 of savings to put to work. This time his purchase at the end of December in 1999 was just before a 50%+ downturn that lasted until 2002. This buy decision left Bob with some more scars but he decided to make one more big purchase with his savings before he retired. The final investment was made in October of 2007 when he invested $64,000 which he had been saving since 2000. He rounded out his string of horrific market timing calls by buying right before another 50%+ crash from the credit blow-up. After the financial crisis, he decided to continue to save his money in the bank (another $40,000) but kept his stock investments in the market until he retired at the end of 2013. To recap, Bob was a terrible market timer with his only stock market purchases being made at the market peaks just before extreme losses. Here are the purchase dates, the crashes that followed and the amount invested at each date: mkt timer Luckily, while Bob couldn’t time his buys, he never sold out of the market even once. He didn’t sell after the bear market of 1973-74 or the Black Monday in 1987 or the technology bust in 2000 or the financial crisis of 2007-09. He never sold a single share. So how did he do? Even though he only bought at the very top of the market, Bob still ended up a millionaire with $1.1 million. How could that be you might ask? First of all Bob was a diligent saver and planned out his savings in advance. He never wavered on his savings goals and increased the amount he saved over time. Second, he allowed his investments to compound through the decades by never selling out of the market over his 40+ years of investing. He gave himself a really long runway. He did have to endure a huge psychological toll from seeing large losses and sticking with his long-term mindset, but I like to think Bob didn’t pay much attention to his portfolio statements over the years. He just continued to save and kept his head down. And finally, he had a very simple and low-cost investment plan — one index fund with minimal costs. Obviously, this story was for illustrative purposes and I wouldn’t recommend a portfolio consisting of 100% in stocks of a single market in the S&P 500 unless you have an extremely high risk tolerance. Even then a more balanced portfolio in different global markets with a sound rebalancing policy makes much more sense. And if he would have simply dollar cost averaged into the market on an annual basis with his savings he would have ended up with much more money in the end (over $2.3 million). But then he wouldn’t be Bob, The World’s Worst Market Timer. Lessons from Bob’s Journey: If you are going to make investment mistakes, make sure you are biased towards optimism and not pessimism. Long-term thinking has been rewarded in the past and unless you think the world or innovation is coming to an end it should be rewarded in the future. As Winston Churchill once said, “I am an optimist. It does not seem too much use being anything else.” Losses are part of the deal when investing in stocks. How you react to those losses is one of the biggest determinants of your investment performance. Saving more, thinking long-term and allowing compound interest to work in your favor are your biggest accelerants for building wealth. These factors have nothing to do with picking stocks or a complex investment strategy. Get these big things right and any disciplined investment strategy should do the trick. https://awealthofcommonsense.com/2014/02/worlds-worst-market-timer/  |

tonylaibach 42.xxx.xxx.207 |

2020-03-23 18:09 |

| [#9707] 港股前瞻 #9700 我係驚打仗! ------------------- 唔怕, 內地有好多志願軍... |

呀金 221.xxx.xxx.152 |

2020-03-23 16:03 |

| [#9706] 港股前瞻 好簡單: 武漢肺炎源頭係中蝈P4 實驗室 |

DeepSea^^ 182.xxx.xxx.107 |

2020-03-23 15:59 |

| [#9705] 港股前瞻 #9700 唔使咁驚喎。而家得美國一個喺度唱獨腳戲嗻嘛。歐盟委員會主席專登錄片多謝中國支援添啊。 各國收到中國醫療物資都多謝前多謝後,根本冇人會同美國一齊癲。 美國本身亦都做唔到啲乜嘢,除咗儘量推莊卸責,侵侵最緊要連任成功,而家連貿易協議都冇人提啦。 |

MMxx 61.xxx.xxx.97 |

2020-03-23 15:39 |

| [#9704] 港股前瞻 承你貴言,我都唔想捱幾十年,退休後過唔到世。 |

hnm 219.xxx.xxx.94 |

2020-03-23 15:38 |

| [#9703] 港股前瞻 #9700,我又唔覺會打仗喎,美國追討賠償都係為錢,講下數每年比返幾多稅,幾多出口貨物。 |

A_Nice_Man 8.xxx.xxx.14 |

2020-03-23 15:33 |

| [#9702] 港股前瞻 我係驚打仗 其實有乜好驚啊 , 打仗係大圍嘅嘢 , 個個人都有份輸 , 最緊要係有條命喺度 , 我一定唔會叫個仔去當兵 , 做炮灰咁戇居 最後修改時間: 2020-03-23 15:31:01 |

ASDF22 223.xxx.xxx.129 |

2020-03-23 15:27 |

| [#9701] 港股前瞻 打仗,一鑊熟,d後生先惨,讀書咁辛苦,讀好了,如打仗又要当兵,充炮灰,惨 |

254mm 1.xxx.xxx.55 |

2020-03-23 15:18 |

| [#9700] 港股前瞻 講真我唔係最擔心疫情對市場嘅直接打擊,始終會過去,可能兩三個月可能再耐啲。 反而最驚係疫情後各國對大陸追討賠償,尤其如果美國死傷嚴重,一定會同大陸計數。 侵侵已經開始將疫情同大陸掛鉤,鋪定路將來追討賠償。 而大陸無論政治上/經濟上都冇可能肯賠或有能力賠,我係驚打仗!! |

hnm 219.xxx.xxx.94 |

2020-03-23 15:12 |

| [#9699] 港股前瞻 回心一想,有得輸好過好多人矣,最緊要手上唔係d 垃圾股,唔會變 wallpaper, 又兼係多餘錢,唔洗排隊上 IFC |

254mm 1.xxx.xxx.55 |

2020-03-23 14:57 |

| [#9698] 港股前瞻 分析唔到個市,唯有分析自己心情? |

Lilaclee 45.xxx.xxx.174 |

2020-03-23 14:44 |

| [#9697] 港股前瞻 #9696 咁。。。要睇下position 係乜先~ 有孖展就快d走。 無既,又睇長線既就睇下手上d公司會唔會執,有冇息派。好似1113咁增派息既,冇乜所謂。 覺得聽日跌咗會好唔開心既,走。 覺得走咗但又升咗就會更唔開心既,守。 升又唔開心,跌又唔開心嘅,回頭是岸! |

spyder 221.xxx.xxx.156 |

2020-03-23 14:29 |

| [#9696] 港股前瞻 當前要慎重考慮既,係個倉要走,定係要守 |

Lilaclee 45.xxx.xxx.220 |

2020-03-23 13:40 |

| [#9695] 港股前瞻 #9693 #9692 多謝. 最後修改時間: 2020-03-23 13:04:00 |

Mercury2015 219.xxx.xxx.244 |

2020-03-23 12:57 |